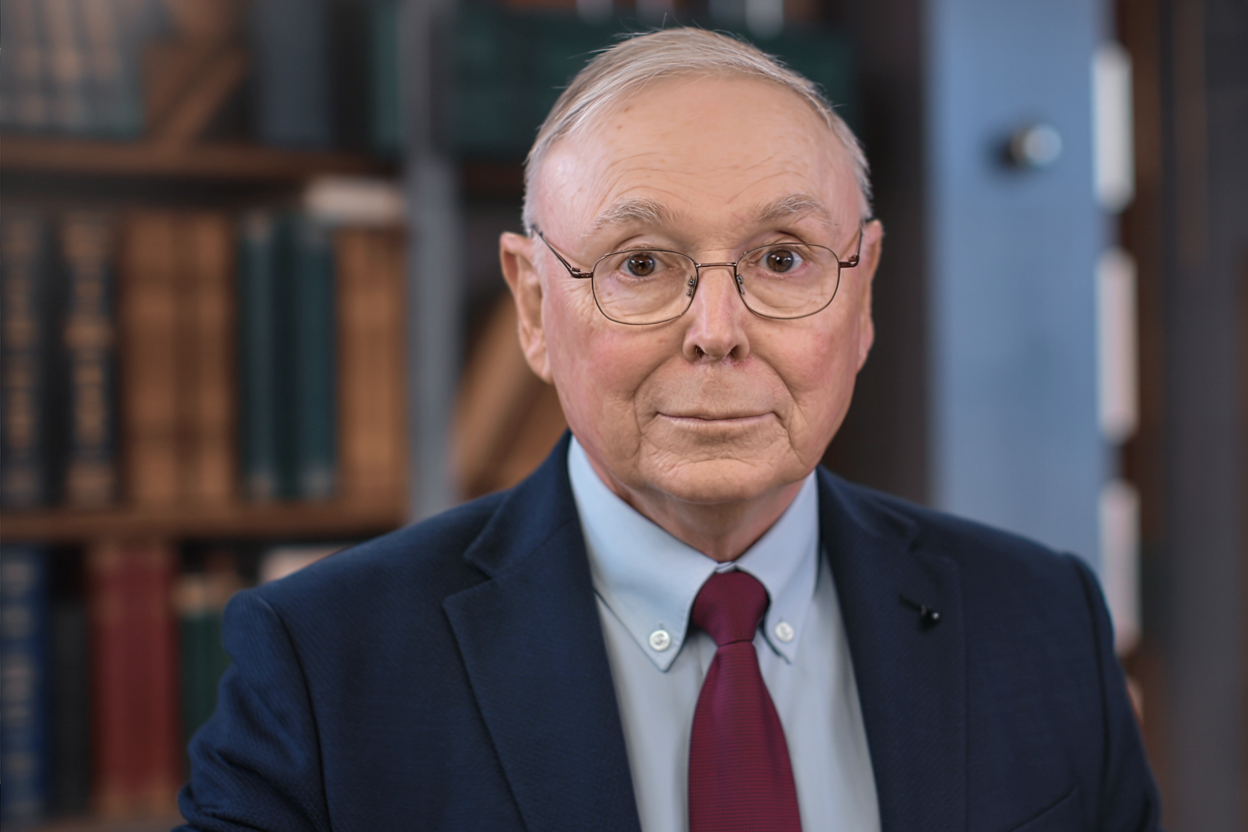

Why Charlie Munger’s Reading List Matters

Charlie Munger spent decades as Warren Buffett’s right-hand man at Berkshire Hathaway, but his real superpower had nothing to do with stock picking. It was reading. Munger was one of the most voracious readers in the history of American business, and he built his entire investment philosophy on what he called “a latticework of mental models” drawn from every major discipline.

He once said, “In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time. None, zero.” That wasn’t a casual observation. It was his core operating principle.

The books he recommended most frequently reveal exactly how he thought about psychology, history, business, and human nature. Here are the 10 books Munger pointed people toward again and again throughout his life.

1. Influence: The Psychology of Persuasion by Robert Cialdini

This was arguably Munger’s single most-cited book. He recommended it in Poor Charlie’s Almanack and referenced it constantly in speeches and interviews. Cialdini’s work on the psychology of persuasion shaped Munger’s famous framework for understanding human misjudgment. He believed that if you don’t know how your own brain is tricked, you’re operating at a severe disadvantage in business and life.

Munger considered the book so vital that he famously sent copies of it to his associates and gifted Cialdini a Class A share of Berkshire Hathaway stock as a personal thank-you. That gesture alone—giving away what is now one of the most expensive individual stocks in the world—tells you how seriously he took its lessons. For Munger, understanding cognitive biases wasn’t optional; it was the foundation of rational decision-making and the antidote to what he called “brain blockages.”

2. Poor Charlie’s Almanack, Edited by Peter Kaufman

This collection of Munger’s speeches, talks, and mental models is the closest thing to having a direct conversation with him. It was the book he most directed people to for understanding his worldview. The almanack covers everything from his thoughts on psychology and economics to his frameworks for avoiding stupidity.

Munger consistently pointed readers here because it captured his multidisciplinary approach in one place. Rather than summarizing a single field, it demonstrated how he pulled ideas from dozens of disciplines and wove them into a coherent system for thinking clearly about complex problems.

3. The Autobiography of Benjamin Franklin

Benjamin Franklin was one of Munger’s all-time heroes. He repeatedly referenced Franklin as a model of self-improvement and practical wisdom. Munger admired how Franklin systematically worked to improve his own character, built wealth through discipline and frugality, and contributed to society through science and public service.

Munger saw Franklin as proof that an ordinary person could become extraordinary through deliberate self-education. He preferred biographies like this because they provided what he called a “cheat sheet” for a person’s entire life. Reading about Franklin’s mistakes and triumphs was a way to learn without having to pay the price yourself.

4. Titan: The Life of John D. Rockefeller, Sr. by Ron Chernow

Munger repeatedly cited this biography as one of the finest business biographies ever written. Chernow chronicles how Rockefeller rose from humble origins to become the world’s richest man by creating Standard Oil. The book captures both the brilliance and the ruthlessness of building an industrial empire from nothing.

For Munger, Titan was essential reading because it showed how a single individual could reshape an entire industry through relentless focus and strategic thinking. He valued business biographies that revealed the real mechanics behind great fortunes, not sanitized success stories.

5. The Outsiders by William Thorndike

Munger called this “a book that details the extraordinary success of CEOs who took a radically different approach to corporate management.” He recommended it at multiple Berkshire Hathaway and Daily Journal annual meetings. Thorndike profiles eight unconventional CEOs who dramatically outperformed their peers by focusing on capital allocation rather than operational flash.

This book aligned perfectly with how Munger and Buffett evaluated business leaders. They never cared about charisma or media presence. They cared about whether a CEO could intelligently deploy capital over long periods. The Outsiders gave concrete proof that quiet, rational capital allocators consistently beat the market.

6. Only the Paranoid Survive by Andy Grove

Munger recommended this book in Poor Charlie’s Almanack, and it aligned with his belief that strategic inflection points require decisive action. Grove, the legendary CEO of Intel, wrote about how businesses must recognize and adapt to fundamental shifts in their industries or face extinction.

Munger referenced Grove’s thinking regularly because it reinforced a principle he applied to investing. The world changes suddenly and dramatically, and the people who survive are those who recognize inflection points early and act decisively rather than clinging to what worked in the past.

7. The Wealth and Poverty of Nations by David Landes

This bestselling exploration of why some nations achieve economic success while others don’t appealed directly to Munger’s love of multidisciplinary thinking. Landes examines centuries of history to identify the cultural, geographic, and institutional factors that separate thriving economies from stagnant ones.

Munger loved this book because it refused to offer simple answers. It drew from economics, history, sociology, and geography simultaneously. That kind of broad, cross-disciplinary analysis was exactly what Munger believed every profound thinker should practice.

8. Guns, Germs, and Steel by Jared Diamond

Munger recommended this alongside Landes’s book as essential reading for understanding how geography, biology, and culture shaped the modern world. Diamond argues that the fates of civilizations were primarily determined by environmental advantages rather than the inherent superiority of any group of people.

Munger cited this book in multiple speeches on mental models because it demonstrated how forces outside of human control shaped entire centuries of history. For an investor trying to understand the big picture of how economies and societies develop, this kind of sweeping analysis was invaluable.

9. Genome by Matt Ridley

Munger recommended this in Poor Charlie’s Almanack and repeatedly praised Ridley’s ability to make complex biology accessible to general readers. The book walks through the human genome one chromosome at a time, exploring what our DNA reveals about disease, behavior, evolution, and human nature.

Munger was a voracious reader of science, and he valued books that helped him understand the biological foundations of human behavior. The genome fit perfectly into his project of building mental models across every discipline. Understanding genetics gave him another lens through which to evaluate how humans think, act, and make decisions.

10. The Warren Buffett Portfolio by Robert G. Hagstrom

This book synthesizes how the investment process actually works through the lens of Buffett’s approach to building a concentrated portfolio. Hagstrom breaks down the principles of focus investing, explaining why owning fewer, higher-conviction stocks can outperform broadly diversified portfolios.

Munger appreciated this book because it captured the practical mechanics of the investment style he and Buffett practiced for decades. It wasn’t about stock tips. It was about understanding the process of rational capital allocation and having the patience to let great businesses compound over time.

Conclusion

The pattern across Munger’s reading list is unmistakable. Psychology, business biography, multidisciplinary science, and historical case studies of how people and civilizations succeed or fail. He wasn’t reading for entertainment. He was systematically building a mental toolkit that enabled him to see the world more clearly than almost anyone else in finance.

Munger’s method was simple but demanding. He read to gather models that worked across multiple fields, then applied them to investment decisions and life choices. For anyone serious about building wealth and thinking independently, his reading list is one of the most valuable starting points available. These ten books won’t just make you a better investor. They’ll make you a better thinker.

Agen234

Agen234

Agen234

Berita Terkini

Artikel Terbaru

Berita Terbaru

Penerbangan

Berita Politik

Berita Politik

Software

Software Download

Download Aplikasi

Berita Terkini

News

Jasa PBN

Jasa Artikel

News

Breaking News

Berita